Corporate Governance Highlights |

Board of Directors

| | | ● | Majority of independent directors (10 of 11)

| | | ● | Separate Chairman and CEO positions since 2003

| | | ● | Majority voting in director elections

| | | ● | Directors limited to service on 5 public company boards (3 for a public company CEO), including the Company

| | | ● | Annual review of skills, expertise and characteristics of individual Board members as part of overall analysis of Board composition

| | | ● | A director who experiences a material change in job responsibilities (other than retirement) is required to offer to resign

|

| |

| Strategy and Risk ●Board actively reviews the development and execution of Company strategy, financial risks and risks related to security, including with respect to data / cyber security, and executive leadership development and succession planning, including an emergency succession plan for the CEO ●Audit Committee oversees overall risk management framework and processes, risks related to accounting and internal controls and various enterprise risks, including supporting the full Board with respect to security risks ●Compensation Committee oversees risks related to compensation policies and practices ●Financial Policy Committee oversees risks related to operating margins and the execution of the Company’s margin improvement plan, capital structure and allocation ●Governance Committee oversees risks related to the Board governance structure and processes and supports the full Board with respect to executive leadership development and succession planning, including an emergency succession plan for the CEO | Board of Directors ●Majority of independent directors (10 of 11) ●Separate Chairman and CEO positions since 2003 ●Majority voting in director elections ●Directors limited to service on no more than 4 other public company boards (2 in the case of a public company CEO) ●Annual review of skills, expertise and characteristics of individual Board members as part of overall analysis of Board composition ●A director who experiences a material change in job responsibilities (other than retirement) is required to offer to resign ●Regular executive sessions of independent directors ●Annual Board and committee self-assessments ●Consideration of Board diversity in director selection | Stockholder Rights and Engagement ●Annual director elections / no classified board ●Proxy access ●Stockholders right to call special meeting ●Annual vote to ratify selection of independent registered public accounting firm ●No poison pill |

| ● | Regular executive sessions of independent directors

| | | ● | Annual Board and committee self-assessments

| | | ● | Consideration of Board diversity in director selection

| |

|

Stockholder Rights and Engagement

2 Cognizant Technology Solutions Corporation

Table of Contents Proxy Statement Summary COMPENSATION

| | | ● | Annual director elections

| | | ● | No classified Board

| | | ● | Proxy access

| | | ● | Stockholders right to call special meeting

| | | ● | Annual vote to ratify selection of independent registered public accounting firm

| | | ● | No poison pill

| | | | | | | ● | Board support for stockholder proposal regarding elimination of supermajority voting provisions

| |

|

Strategy and Risk

| | | ● | Board actively reviews the development and execution of Company strategy

| | | ● | Board oversight and responsibility for risk management, including

| |

| ● | Enterprise risks, including cyber security, overall risk management framework and risks related to the financial statements overseen by the Audit Committee

| | | ● | Risks related to compensation policies and practices overseen by the Compensation Committee

| | | ● | CEO succession planning and other corporate governance risks overseen by the Board with the assistance of the Governance Committee

| |

2 Cognizant Technology Solutions Corporation

Table of Contents

Proxy Statement Summary

| Proposal 2 | Advisory Vote on Executive Compensation (Say-on-Pay) | ●Our executive compensation program is designed to incentivize management to achieve the Company’s objectives of revenue growth, profitability, cash flow and total return to stockholders. |  | The Board unanimously recommends a vote FORthe approval, on an advisory (non-binding) basis, of our executive compensation. |  | See page 26 for further information |

Executive Compensation Program Highlights Key Program Features | What We Do | | | | | What We Don’t Do |  Pay for performance, with high percentages of performance-based and long-term equity compensation Pay for performance, with high percentages of performance-based and long-term equity compensation |  | See page 29 | |  No hedging or speculation with respect to Cognizant securities No hedging or speculation with respect to Cognizant securities |  | See page 35 |  Use appropriate peer groups and market data when establishing compensation Use appropriate peer groups and market data when establishing compensation |  | See page 28 | |  No short sales of Cognizant securities No short sales of Cognizant securities |  | See page 35 |  Retain an independent external compensation consultant Retain an independent external compensation consultant |  | See page 28 | |  No margin accounts with Cognizant securities No margin accounts with Cognizant securities |  | See page 35 |  Set significant stock ownership requirements for executives Set significant stock ownership requirements for executives |  | See page 34 | |  No pledging of Cognizant securities No pledging of Cognizant securities |  | See page 35 |  Maintain a strong clawback policy Maintain a strong clawback policy |  | See page 35 | |  No tax “gross ups” on severance benefits No tax “gross ups” on severance benefits |  | See page 36 |  Utilize “double trigger” change in control provisions in plans Utilize “double trigger” change in control provisions in plans |  | See page 42 | | | | |

Executive Compensation Program Highlights |

Key Program Features

| | What We Do | | See Page No. | ✓ | | Pay for performance

| | 25

| ✓ | | Use appropriate peer groups when establishing compensation

| | 24

| ✓ | | Retain an independent external compensation consultant

| | 24

| ✓ | | Set significant stock ownership guidelines for executives

| | 30

| ✓ | | Include a clawback policy in our incentive plans

| | 31

| ✓ | | Utilize “double trigger” provisions for plans that contemplate a change in control

| | 38

|

| | What We Don’t Do | | See Page No. | ✕ | | No hedging or speculation with respect to Cognizant securities

| | 30

| ✕ | | No short sales of Cognizant securities

| | 30

| ✕ | | No margin accounts with Cognizant securities

| | 30

| ✕ | | No tax “gross ups” on severance benefits

| | 32

|

Program Objectives The Compensation Committee has designed the executive compensation program for our NEOs to meet the following objectives: ● | Ensure executive compensation is aligned with our corporate strategies and business objectives and that potential realizable compensation is set relative to each executive’s level of responsibility and potential impact on our performance;

| ● | A substantial portion of an executive officer’s compensation is subject to achieving both short-term and long-term performance objectives that enhance stockholder value;

| ● | Reinforce the importance of meeting and exceeding identifiable and measurable goals through superior awards for superior performance;

|

● | Provide total direct compensation that is competitive in markets in which we compete for management talent in order to attract, retain and motivate the best possible executive talent;

| ● | Provide an incentive for long-term continued employment with our Company; and

| ● | ●Ensure executive compensation is aligned with our corporate strategies and business objectives and that potential realizable compensation is set relative to each executive’s level of responsibility and potential impact on our performance; ●Tie a substantial portion of executive officer compensation to achieving both short-term and long-term performance objectives that enhance stockholder value; ●Reinforce the importance of meeting and exceeding identifiable and measurable goals through superior awards for superior performance; ●Provide total direct compensation that is competitive in markets in which we compete for management talent in order to attract, retain and motivate the best possible executive talent; ●Provide an incentive for long-term continued employment with our Company; and ●Reinforce our desired culture and unique corporate environment by fostering a sense of ownership, urgency and overall entrepreneurial spirit. | Company Performance and Impact on Compensation Program The Compensation Committee set 2017 executive compensation in March 2017, except with respect to Mr. Friedrich, who joined the Company in May 2017. The Compensation Committee’s decisions with respect to 2017 executive compensation were primarily based on: ●The Company’s performance during 2017, 2016 and in previous years, including relative to its industry; ●Anticipated and desired Company performance for 2017 and 2018 based on Company and industry projections and Company goals; ●Individual executive performance and responsibility; and ●The market for executive talent. The Compensation Committee believes that the design of the compensation program, including having the appropriate mix of compensation elements and performance metrics and targets, has a significant impact on driving Company performance. ●The performance by the Company in 2015, 2016 and 2017 across the performance metrics and targets selected by the Compensation Committee is set forth under “Aligning Pay with Performance.”  See page 6 for further information See page 6 for further information●Details of the compensation elements and performance by the Company in 2015, 2016 and 2017 against each of the performance-based compensation elements is set forth under “2017 Compensation Structure.”  See page 4 for further information See page 4 for further information |

2018 Proxy Statement 3

Table of Contents Proxy Statement Summary | 2017 Compensation Structure |

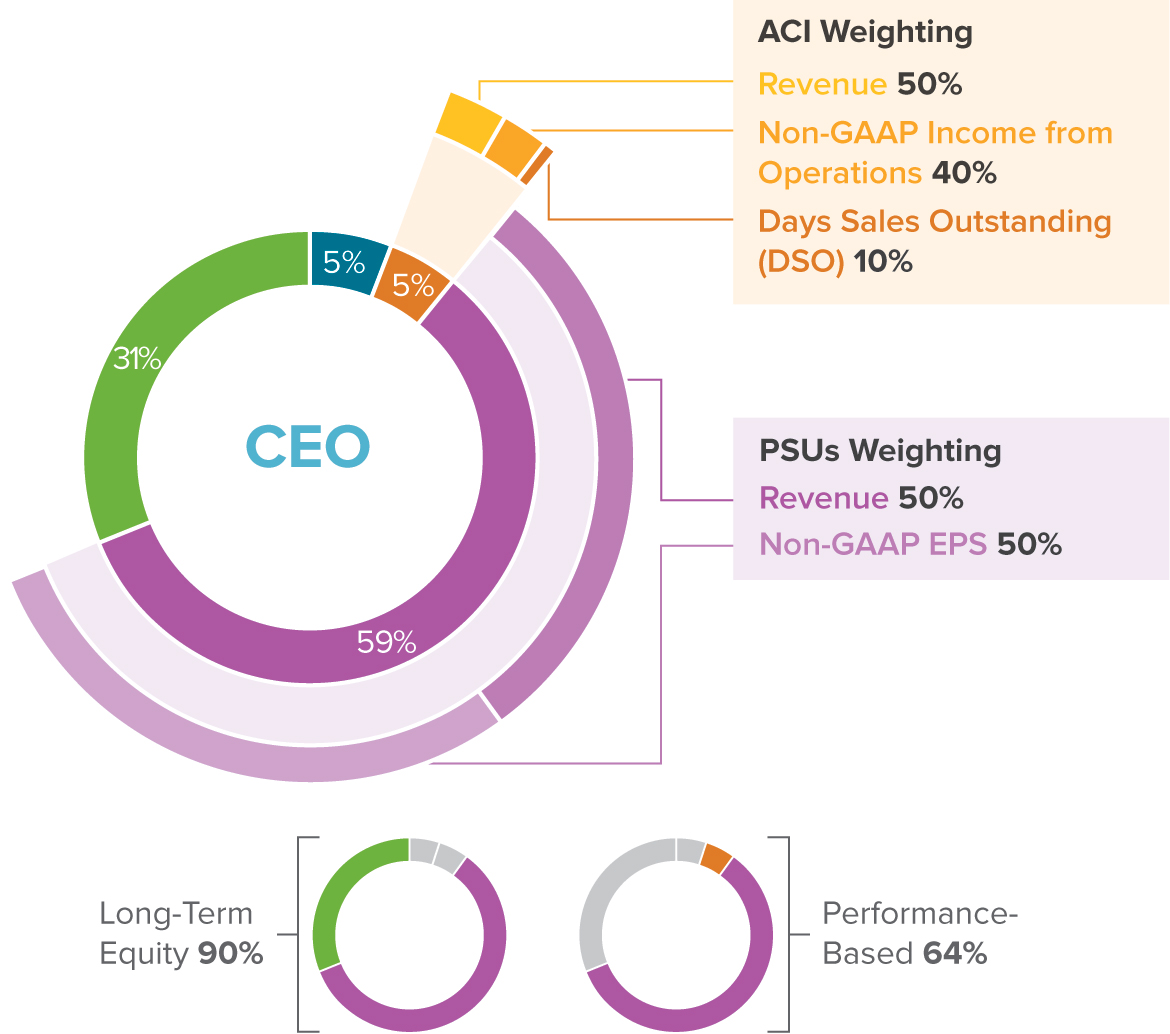

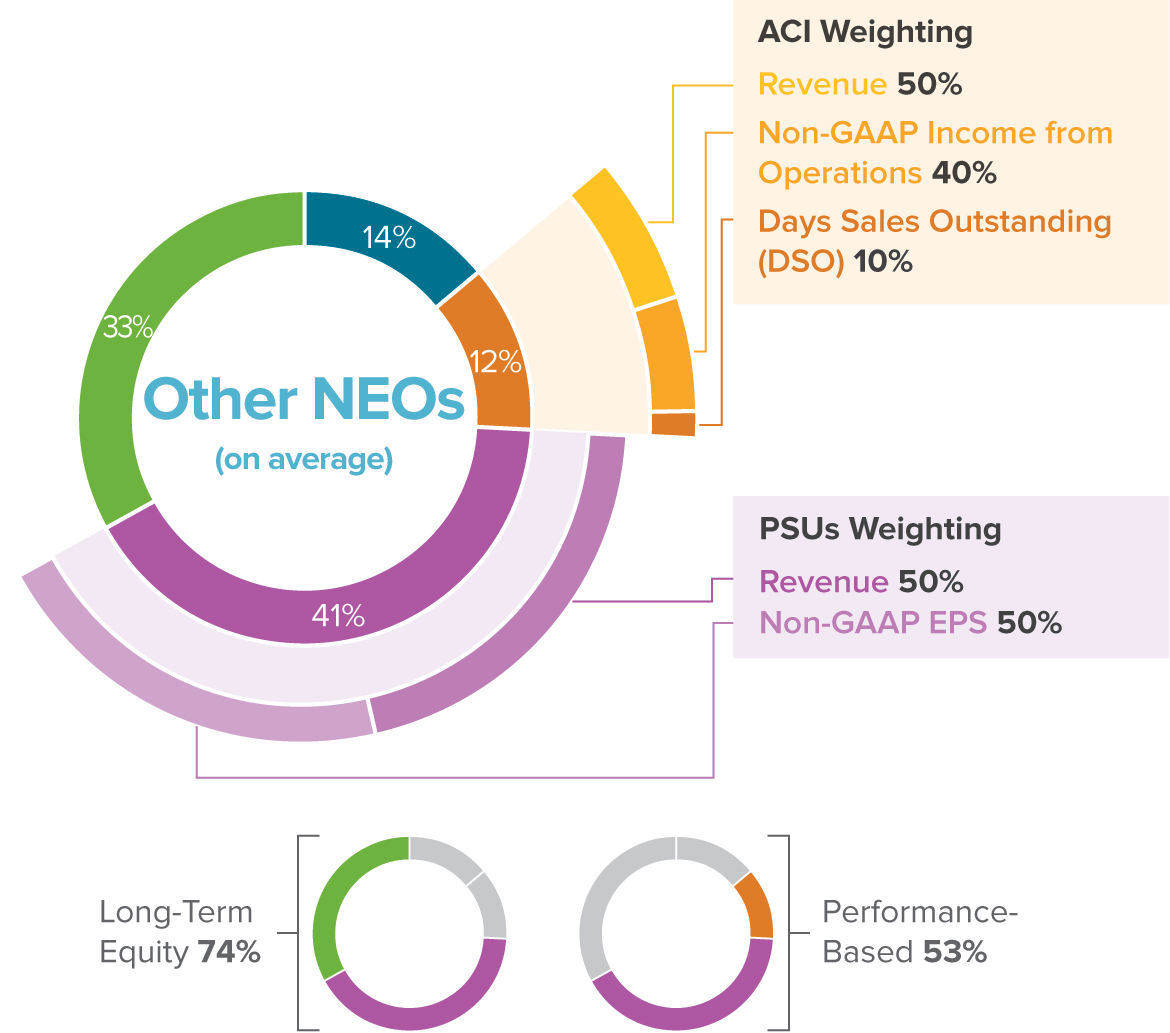

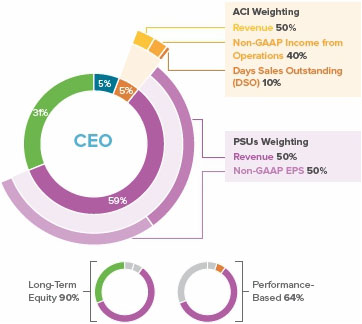

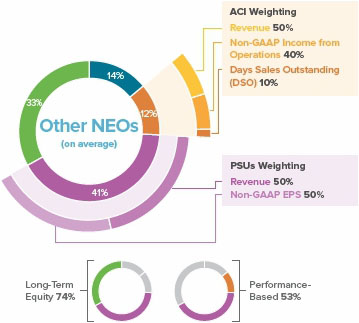

The Compensation Committee makes decisions on executive compensation from a total direct compensation perspective. Each element is considered by the committee in meeting one or more compensation program objectives. The following chart illustrates the balance of elements of 2017 target total direct compensation for our CEO and other NEOs, as described in this proxy statement. Base Salary | Stable source of cash income at competitive levels |

Table of Contents

Proxy Statement Summary

2016 Compensation StructureAnnual Cash Incentive (ACI)

■ | | Base Salary

| Stable source of cash income at competitive levels

|

■ | | Annual Cash Incentive / Cash Bonus

| Annual cash incentive for Mr. D’Souza, Mr. Mehta and Ms. McLoughlin to motivate and reward achievement of Company financial and operational objectives |

Weighting | | Measurement Period | | Target Compensation | | Measurement Period | Target Compensation | | 1 year (2017) | 85% of base salary |  | | Revenue

| | 1 year

| | 85% of base salary

| | | | | Payout Range

|

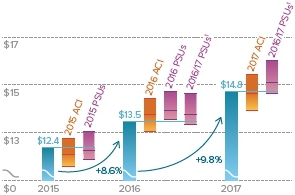

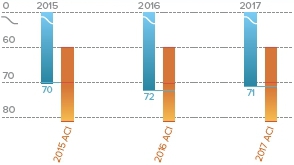

Historical ACI award achievements by year | | 2015 | 2016 | 2017 | | 142.0% | 79.8% | 114.8% |

Performance Stock Units (PSUs) | | |  | | Non-GAAP Income from Operations

| |

| | |  | | Days Sales Outstanding (DSO)

| | | |

| Historical Annual Cash Incentiveaward achievements by year | 2014 | | 2015 | | 2016 | | 96.2% | | 142.0% | | 79.8% |

Cash bonus for Mr. Chintamaneni and Mr. Sinha based on achievement of business unit and/or overall business goals and expanded responsibilities in 2016

■ | | Performance Stock Units (PSUs)

| Annual grant of performance stock units that reward achievement of Company financial objectives, continued service and long-term performance of our common stock |

| Measurement Period | Vesting | | 2 years (2017-2018) | 1/3rd at 30 months | | 2/3rds at 36 months | Vesting Range

Weighting1 | | Measurement Period | | Vesting |  | | Revenue

| | 2 years

| | 1/3rd at 30 months

| | | | | Vesting Range

|

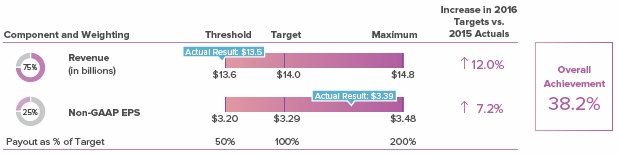

Historical PSU achievements by performance measurement period | | 20151 | 20162 | 2016/172 | | 122.9% | 38.2% | 85.5% |

Restricted Stock Units (RSUs) | | 2/3rds at 36 months

|  | | Non-GAAP EPS

| |

| | |

| Historical PSU achievements byperformance measurement period | 20141 | | 20151 | | 2016 | | 86.1% | | 122.9% | | 38.2% |

Weighting for 2017 awards– 50% Revenue; 50% non-GAAP EPS

■ | | Restricted Stock Units (RSUs)

| Annual grantsGrants of restricted stock units to reward continued service and long-term performance of our common stock

|

| Grants Annually for Mr. D’Souza (CEO), Mr. Mehta and Ms. McLoughlin; every 3 years for Mr. Chintamaneni and Mr. Friedrich | VestingQuarterly over 3 years | | |

2017 Target Annual Compensation Mix |  |  |

Note: The above presentation seeks to provide a view of 2017 total direct compensation as reviewed by the Compensation Committee. As such, it uses grant date share prices for RSUs and PSUs and the target level of achievement for the ACI and PSUs. The above presentation excludes additional grants of RSUs and PSUs to Mr. Mehta and Mr. Chintamaneni made in connection with the expansion of their roles in 2016 and the signing bonus and grants of RSUs and PSUs to Mr. Friedrich upon his joining the Company in 2017. | 1 | Weighting was 100% revenue for the 2015 performance measurement period. | | 2 | Weighting was 75% revenue and 25% non-GAAP EPS for the 2016 and 2016/17 performance periods. |

4 Cognizant Technology Solutions Corporation

Table of Contents Proxy Statement Summary 2017 Target Direct Compensation of Our Named Executive Officers  | | Q4Francisco D’Souza CEO

| | Committee Assessment 3% overall increase in target direct compensation vs. 2016 to Q1reflect general market trends | | Compensation Decisions for 2017 Target Direct Compensation– $12,232,013 ●Set close to median but weighted more heavily towards equity compensation vs. Company peer group, providing the opportunity for higher realized compensation based on Company performance ●~0% change in base salary or annual cash incentive from 2016 ●Annual PSU and RSU grants increased by 3% from 2016 |  | | Rajeev Mehta President | | Committee Assessment 3% overall increase in target direct compensation vs. 2016 annual target direct compensation after a 14% increase upon his promotion to President in September 2016 | | Compensation Decisions for 2017 Target Direct Compensation– $6,816,724 ●No changes in base salary or annual cash incentive from September 2016 ●Annual PSU and RSU grants increased by 3% and 4%, respectively, from 2016 Additional grants of PSUs ($898,775) and RSUs ($599,160), not included in target direct compensation, made in 2017 in connection with his promotion to President in 2016 |  | | Karen McLoughlin CFO | | Committee Assessment 8% overall increase in target direct compensation for 2017 to align compensation to market | | Compensation Decisions for 2017 Target Direct Compensation– $3,930,130 ●Base salary and annual cash incentive increased by 17% from 2016 ●Annual PSU and RSU grants increased by 5% and 6%, respectively, from 2016 |  | | Ramakrishna Prasad Chintamaneni EVP and President, Global Industries and Consulting | | Committee Assessment Target direct compensation increased 31% at the time of his promotion to his current role in December 2016; no further changes made in 2017 | | Compensation Decisions for 2017 Target Direct Compensation– $3,099,236 ●No changes in base salary and annual cash incentive from December 2016 ●Annual grant timing changeof PSUs ($1,041,603) ●RSUs – $1,178,883 in grant date fair value targeted to vest annually; grants made in multiple once-every-three-year reloads |  | | Matthew W. Friedrich EVP, General Counsel, Chief Corporate Affairs Officer and Secretary | | Committee Assessment Overall compensation package based on market data for public company general counsels; signing bonus and equity grants provided additional incentives for joining the Company in May 2017 | | Compensation Decisions for 2017 Target Direct Compensation– $2,723,968 ●Base salary of $525,000 and annual cash incentive of 85% of base salary ●Annual grant of PSUs ($751,166) ●RSUs – $1,001,552 in grant date fair value targeted to vest annually as part of a once-every-three year grant Signing bonus ($500,000) and grants of PSUs ($500,778) and RSUs ($1,251,941), not included in target direct compensation, made upon his joining the Company |

2017 Compensation

(in thousands) | Name and Principal Position | | Year | | | Salary | | Cash

Bonus | | Annual

Cash

Incentive | | PSU | | RSU | | | All Other

Pension and

Deferred

Comp. | | All

Other

Comp. | | SEC

Total | | Adjusted

SEC

Total | 1 | Francisco D’Souza

CEO

| | 2017 | | | $ | 669 | | | — | | $ | 648 | | $ | 7,220 | | $ | 3,774 | | | — | | $ | 167 | | $ | 12,478 | | $ | 12,478 | | | 2016 | | | $ | 664 | | | — | | $ | 450 | | $ | 7,019 | | | — | 1 | | — | | $ | 123 | | $ | 8,257 | | $ | 12,031 | | Rajeev Mehta

President | | 2017 | | | $ | 630 | | | — | | $ | 615 | | $ | 4,604 | | $ | 2,545 | | | — | | $ | 56 | | $ | 8,450 | | $ | 8,450 | | | 2016 | | | $ | 574 | | | — | | $ | 389 | | $ | 3,584 | | | — | 1 | | — | | $ | 6 | | $ | 4,554 | | $ | 7,099 | | Karen McLoughlin

CFO | | 2017 | | | $ | 500 | | | — | | $ | 488 | | $ | 1,967 | | $ | 1,038 | | | — | | $ | 8 | | $ | 4,001 | | $ | 4,001 | | | 2016 | | | $ | 427 | | | — | | $ | 289 | | $ | 1,876 | | | — | 1 | | — | | $ | 8 | | $ | 2,599 | | $ | 3,638 | | Ramakrishna Prasad

Chintamaneni

EVP and President, Global

Industries and Consulting | | 2017 | | | $ | 475 | | | — | | $ | 463 | | $ | 1,042 | | $ | 1,897 | | | — | | $ | 8 | | $ | 3,885 | | $ | 3,885 | | | 2016 | | | $ | 417 | | $ | 566 | | | — | | $ | 831 | | $ | 1,615 | | | — | | $ | 8 | | $ | 3,437 | | $ | 3,437 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Matthew W. Friedrich

EVP, General Counsel,

Chief Corporate Affairs Officer

and Secretary | | 2017 | 2 | | $ | 330 | | $ | 500 | | $ | 512 | | $ | 1,252 | | $ | 4,257 | | | — | | $ | 132 | | $ | 6,983 | | $ | 6,983 | |

| 1 | The Company moved the timing of annual RSU grants for Mr. D’Souza, Mr. Mehta and Ms. McLoughlincertain NEOs from the fourth quarter of 2016 to the first quarter of 2017 to align with the timing of the Company’s other annual equity grants and other annual compensation decisions by the Compensation Committee. As such, to presentTo provide stockholders annual compensation numbers that are more comparable year-to-year, an Adjusted SEC Total is presented, which total includes the intended target total direct compensation in a more meaningful manner, the RSU percentages shownSEC Total plus, for 2016, includean amount equal to the target value of the RSU grants made to such executives in the first quarter of 2017 (using a March 2, 2017 grant date fair value) to Mr. D’Souza ($3,774), Mr. Mehta ($2,545) and Ms. McLoughlin ($1,038). The same RSU grants are also included for 2017. 1 | | Weighting was 100% revenue for the 2014 and 2015 performance measurement periods.

| 2 | | Excludes Mr. Coburn, who resigned from the Company during 2016.

|

2016 Target Annual Compensation |  | |  | CEO | | Other NEOs2

(on average) |

■ | | Base Salary | ■ | | Annual Cash Incentive / Cash Bonus | ■ | | Performance Stock Units (PSUs) | ■ | | Restricted Stock Units (RSUs) |

4 Cognizant Technology Solutions Corporation

Table of Contents

Proxy Statement Summary

2016 Compensation

( The amounts in thousands)

Name and Principal

Position | | Year | | Salary | | Cash

Bonus | | Annual

Cash

Incentive | | PSU | | RSU | | All Other

Pension and

Deferred

Comp. | | All

Other

Comp. | | SEC

Total | | Adjusted

SEC

Total1 | | Francisco D’Souza | | 2016 | | $664 | | – | | $450 | | $7,019 | | –1 | | – | | $123 | | $8,257 | | $12,031 | | CEO | | 2015 | | $645 | | – | | $778 | | $6,814 | | $3,669 | | – | | $45 | | $11,951 | | $11,951 | | Rajeev Mehta | | 2016 | | $574 | | – | | $389 | | $3,584 | | –1 | | – | | $6 | | $4,554 | | $7,099 | | President2 | | 2015 | | $539 | | – | | $650 | | $3,480 | | $1,874 | | – | | $2 | | $6,544 | | $6,544 | | Gordon J. Coburn | | 2016 | | $467 | | – | | – | | $3,751 | | – | | $184 | | $93 | | $4,495 | | $4,495 | | Former President2 | | 2015 | | $614 | | – | | $740 | | $3,641 | | $1,961 | | – | | $89 | | $7,045 | | $7,045 | | Karen McLoughlin | | 2016 | | $427 | | – | | $289 | | $1,876 | | –1 | | – | | $8 | | $2,599 | | $3,638 | | CFO | | 2015 | | $406 | | – | | $490 | | $1,821 | | $981 | | – | | $8 | | $3,706 | | $3,706 | Ramakrishna Prasad

Chintamaneni | | 20163 | | $417 | | $566 | | – | | $831 | | $1,615 | | – | | $8 | | $3,437 | | $3,437 | EVP and President,

Global Industries and

Consulting | | | | | | | | | | | | | | | | | | | | | Dharmendra

Kumar Sinha | | 20163 | | $357 | | $168 | | – | | $714 | | $1,762 | | – | | $8 | | $3,009 | | $3,009 | EVP and President,

Global Client Services | | | | | | | | | | | | | | | | | | | | |

1 | The Company moved the timing of annual RSU grants for certain NEOs from the fourth quarter of 2016 to the first quarter of 2017 to align with the timing of the Company’s other annual equity grants and other annual compensation decisions by the Compensation Committee. The Adjusted SEC Total represents the SEC Total plus, for 2016, the target value of the RSU grants made in the first quarter of 2017 (using a March 2, 2017 grant date fair value) to Mr. D’Souza ($3,774), Mr. Mehta ($2,545) and Ms. McLoughlin ($1,038) to provide stockholders annual compensation numbers that are more comparable to past years and more indicative of the targeted annual compensation to the NEOs. These amounts are not a substitute for the amounts reported under the SEC Total. | 2 | Mr. Mehta was appointed President of Cognizant on September 28, 2016, following the resignation of Mr. Coburn on September 27, 2016. | 3 | 2015 compensation not presented for Mr. Chintamaneni and Mr. Sinha as they were not NEOs in that year. |

| | Aligning Pay with Performance |

The following graphs show Company performance across revenue, profitability and cash flow metrics for the last three years as compared toamounts reported under SEC Total.

| | 2 | Mr. Friedrich joined the performance targets for the annual cash incentives and PSUs with performance measurement periods correspondingCompany in 2017. |

2018 Proxy Statement 5

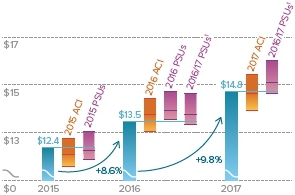

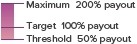

Table of Contents Proxy Statement Summary Aligning Pay with Performance The following graphs show Company performance across revenue, profitability and cash flow metrics for the last three years as compared to the performance targets for the annual cash incentives (ACIs) and PSUs with performance measurement periods covering such years. In addition, the Company’s share price performance, which impacts the performance of long-term equity grants to the NEOs and holdings of our common stock, is set forth below for the last five years. (in billions)  | ● | Revenue

Continued strong, consistent revenue growth(remains a key Company objective

| | ● | Appropriate targets and significant weightinghave helped drive revenue growth |

| | | | Target

Increase2 | | Weighting | | Payout Range | | 2015 ACI | | 19.0% | | 50% | |  | | 2016 ACI | | 11.0% | | 50% | | | 2017 ACI | | 9.0% | | 50% | | | 2015 PSUs | | 19.1% | | 100% | |  | | 2016 PSUs | | 12.0% | | 75% | | | 2016/17 PSUs | | 11.0% | | 75% | |

| ● | Reduced revenue weighting in billions)2017 awardsof 2017/18 PSUs (from 75% to 50%) as weighting of non-GAAP EPS increased (from 25% to 50%) to reflect focus on profitability | | ● |

Annual Cash Incentive | PSUs1 |

|

Strong, consistent revenue growth

8.6% 8.6%

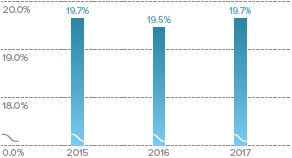

Year-over-year revenue growth (2015 to 2016) | | Non-GAAP Operating Margin3 | |

| ● | Compensation ImpactsHistorical 19-20% target

● | Significant weighting in both performance-based compensation elements

| ● | Aggressive targets have helped drivefor non-GAAP Operating Margin, with the ACI targets for non-GAAP Income from Operations (40% weighting) increased each year to maintain margin target while revenue growth was encouraged

| | ● | 2019 goal of 22%that the Company plans to achieve by accelerating the pursuit of high-value digital transformation work, driving leverage in the cost structure, executing on opportunities to improve operational efficiency and aggressively employing automation to optimize traditional services3,4 |

| ● | 2018 ACI targets for non-GAAP Income from Operations designed to incentivize an increase in non-GAAP Operating Margin during 2018 towards the 2019 goal |

ForNon-GAAP Income from Operations3 | |

(in millions)  | ● | Historically increased in line with revenue target increasesto maintain non-GAAP Operating Margin in the 19-20% range |

| | | | Target

Increase2 | | Weighting | | Payout Range | | 2015 ACI | | 14.8% | | 40% | |  | | 2016 ACI | | 9.8% | | 40% | | | 2017 ACI | | 8.9% | | 40% | |

| ● | 2018 ACI targets for non-GAAP Income from Operations designed to incentivize an increase in non-GAAP Operating Margin during 2018 towards the2019 goal of 22% non-GAAP Operating Margin3,4 |

| 1 | 2016/17 PSU targets were based on combined performance of the Company for 2016 and 2017. The combined target was allocated between 2016 and 2017 awards: Revenuein the graph in the same proportion as actual revenue in such years such that the same level of achievement is reflected in both years. | | 2 | Increase in target (compound annual growth for 2017/18 PSUs) vs. prior year actual Company performance. | | 3 | See “Non-GAAP Financial Measures and Forward-Looking Statements” on page 65. | | 4 | 2019 goal excludes any changes to the regulatory environment, including with respect to immigration and taxes. See our 2017 Annual Report for these and other risk factors that may impact our ability to achieve this goal. |

6 Cognizant Technology Solutions Corporation

Table of Contents Proxy Statement Summary | Non-GAAP Diluted Earnings Per Share (EPS)1 | |

| ● | PSU metric added in 2016to incentivize increased profitability | | ● | Appropriate targets and significant weighting |

| | | | Target

Increase3 | | Weighting | | Payout Range | | 2015 PSUs | | — | | — | |  | | 2016 PSUs | | 10.4% | | 25% | | | 2016/17 PSUs | | 10.7% | | 25% | |

| ● | Increased non-GAAP EPS weighting in 2017 awardsof 2017/18 PSUs (from 25% to 50%) as weighting of revenue reduced (from 75% to 50% weighting for PSUs) to reflect increased Company focus on profitability | | ● | 2017/18 PSU targets for non-GAAP Operating Margin.EPS aligned with 1 | Applies to PSUs with a 2016 performance measurement period. PSUs with a 2014 or 2015 performance measurement period are weighted 100% to revenue. PSUs issued in 2016 have a 2-year performance measurement period covering 2016 and 2017 and are not shown. |

Table2019 goal of Contents

Proxy Statement Summary

Profitability

Non-GAAP22% non-GAAP Operating Margin11,4

Non-GAAP Operating Margin

| 19% – 20%

| Historical target consistently maintained, with excess reinvested in the Company for future growth, resulting in steadily increasing non-GAAP Income from Operations and non-GAAP EPS as the Company’s revenue has increased.

| 2019 Goal1,2

22%

| …by accelerating the pursuit of high-value digital transformation work, driving leverage in the cost structure, executing on opportunities to improve operational efficiency and aggressively employing automation to optimize traditional services. |

| ● | Non-GAAP Income from Operations1

(PSUs awarded in millions)2017 (2017/18 PSUs) not shown as their 2-year performance period is ongoing

Annual Cash Incentive |  |

Non-GAAP Diluted Earnings Per Share (EPS)1

PSUs3 |  |

Non-GAAP

Income from Operations | Non-GAAP EPS| Cash Flow |  7.6% |  10.4% | (2015-2016)

|

Compensation Impacts

● | Targets have historically been designed to achieve 19-20% non-GAAP Operating Margin, with targets increased each year to maintain that margin as revenue growth is encouraged

| ● | Profitability has been an increasingly important component of the Company’s performance-based compensation with the addition of the non-GAAP EPS metric for PSUs in 2016

|

For 2017 awards:

● | Targets designed around planned increases in non-GAAP Operating Margin for future years (see 2019 Goal above)

| ● | Non-GAAP EPS increased to 50% weighting for PSUs; target accounts for $1.5 billion accelerated share repurchase program initiated in March 2017

|

1 | See “Non-GAAP Financial Measures and Forward-Looking Statements” on page 57. | 2 | 2019 goal excludes any changes to the regulatory environment, including with respect to immigration and taxes. See our Annual Report for these and other risk factors that may impact our ability to achieve this goal. | 3 | Applies to PSUs with a 2016 performance measurement period. PSUs with a 2014 or 2015 performance measurement period do not use non-GAAP EPS as a performance metric. PSUs issued in 2016 have a 2-year performance measurement period covering 2016 and 2017 and are not shown. |

6 | Cognizant Technology Solutions Corporation |

Table of Contents

Proxy Statement Summary

Cash Flow

Days Sales Outstanding (DSO)

Annual Cash Incentive | |  |

Consistent DSO year-to-year

| ● | Timely collection of receivablesfrom customers incentivized by this ACI performance metric |

| Collection of receivables from customers has remained steady over the past three years.

|

| ● | DSO target set at a level the Compensation Impact ● | Target established to ensure managementCommittee believes is incentivized to maintain collection of receivables at a healthy level for the business

|

| | ● | DSO has remained steadyover the past three years |

|

| | Weighting | | Payout Range | | 2015 ACI | | 10% | |  | | 2016 ACI | | 10% | | | 2017 ACI | | 10% | |

| Stockholder Return | 5-Year Cumulative Total Stockholder Return15

1 | Comparison assumes $100 was invested, from December 31, 2011 through December 31, 2016, in Cognizant common stock, the S&P 500 Index, the NASDAQ 100 Index and our peer group (capitalization weighted), and that all dividends were reinvested. | 2 | Consists of the following information technology consulting firms: Accenture plc, Computer Sciences Corporation, Computer Task Group, Incorporated, ExlService Holdings Inc., Genpact Limited, Infosys Limited, Syntel, Inc., Wipro Limited and WNS (Holdings) Limited. |

5-year Compound Average Growth

in Share Price |  11.7% 11.7% | (2012-2016) |

Compensation Impact

● | A substantial percentage of NEO compensation is in the form of long-term equity compensation (RSUs and PSUs), aligning management incentives with those of stockholders

|

● | RSUs vest quarterly over three years

| ● | PSUs issued in 2011 through 2015 vest at 18 months and 36 months and have a 1-year performance measurement period

| ● | PSUs issued in 2016 vest at 30 months and 36 months and have a 2-year performance measurement period

|

● | All of our NEOs hold substantial ownership interests in our common stock, in excess of the requirements under our stock ownership guidelines, further aligning their interests with those of stockholders

| ● | Reduced stockholder return in the last three years has reduced realized compensation to NEOs from their equity grants and stockholdings

|

Table of Contents

Proxy Statement Summary

● | Allow for the issuance of up to 46,000,000 new shares, in addition to the approximately 7,000,000 remaining available for issuance under the 2009 Plan that will be transferred to the Plan, bringing the total number of shares available for new grants under the Plan to approximately 53,000,000, which we expect to last us approximately six years;

| ● | Provide for the number of shares reserved for issuance to be reduced by two shares for each share of stock issued pursuant to a full-value award, including a PSU or an RSU, which would replace the 1.55 share reduction for each share of stock issued pursuant to a full-value award under the 2009 Plan;

| ● | Provide for a term through March 27, 2027;

| ● | Clarify that all awards are subject to the provisions of any clawback policy we implement;

| ● | Establish an annual dollar figure limit for director compensationof $900,000, which applies to both cash and equity compensation and would replace the 100,000 share limit for director equity compensation under the 2009 Plan;

| ● | Provide for an annual per-person dollar figure limit for cash awardsof $10,000,000, which represents an increase from the $5,000,000 per-person cash award limit under the 2009 Plan; and

| ● | Establish an annual per-person share limit of (i) 3,000,000 for stock option and stock appreciation right awards and (ii) 2,000,000 for PSUs and RSUs, which would replace the annual per-person share limit for all awards of 5,000,000 under the 2009 Plan.

|

| | Key Information About Plan Features and Our Equity Compensation Share Usage1 |

| | What this measures | | How we manage | Burn Rate | | How rapidly we are using an equity plan’s share pool | | Over the last three years, our burn rate, which we calculate on a gross basis, averaged 0.78%. The burn rates for the last three years were 1.02%, 0.46% and 0.86% for 2014, 2015 and 2016, respectively. The Board believes that such burn rates are acceptable. | Overhang | | Potential stockholder dilution from outstanding equity award shares available for grant | | If this proposal is adopted, our overhang, calculated using a simple overhang measurement, will be 10.4%. The Board believes that the requested number of shares of common stock under the Plan represents a reasonable amount of potential equity dilution. |

Good Governance Features of the Plan

What the Plan Does |  | Limits on authorized shares |  | No evergreen provision |  | All awards subject to clawback |  | 10-year maximum stock option term |  | Certain shares surrendered, withheld or repurchased may not again be made available for issuance | | | What the Plan Doesn’t Do |  | No stock option repricing |  | No discounted stock option grants |  | No automatic change in control benefits |

Our Current Equity Grant Practices

What We Do

|  | Mix of PSUs and RSUs with an emphasis on PSUs for senior executives

|  | Long-term vesting such that PSUs have a 2-year performance measurement period and, for executive officers, vest 1/3rd at 30 months and 2/3rds at 36 months and, for other employees, fully vest at 29 months following the start of such period; RSUs vest quarterly over three years from grant

| | | What We Don’t Do

|  | No dividend equivalent payments on unearned PSUs or RSUs (accumulated dividend equivalents paid only on vesting)

|

1 | Cognizant data covers 2014-2016. Please see “Key Data About our Grant Practices” on page 42 for more information about these metrics and how we calculate them. |

8 | Cognizant Technology Solutions Corporation |

Table of Contents

Table of Contents

| PROPOSAL 1 | | ELECTION OF DIRECTORS

| | What are you

voting on?

| At the Annual Meeting, 11 Directors are to be elected to hold office until the 2018 Annual Meeting and until their successors have been duly elected and qualified. All nominees are current Directors and all except Ms. Atkins and Mr. Dineen were elected by stockholders at the 2016 Annual Meeting.

|  |  The Board unanimously recommends a voteFOR all the Director nominees listed below. |

Independent

Retired President of PepsiCo, Inc.

| | Director Since2015

Age58

BirthplaceSudan | | Committees

●Audit

●Governance

| | Skills and Qualifications| ● | 14.1% compound annual growth ratein share price over the last 5 years (2013 – 2017) | | ● | Substantial portion of executive compensation in the form of long-term equity compensation(RSUs and PSUs), aligning management incentives with those of stockholders | | ● | Stock ownership guidelinesfurther align executive incentives with those of stockholders (see “Executive Stock Ownership Guidelines” on page 34) | |

| 1 | See “Non-GAAP Financial Measures and Forward-Looking Statements” on page 65. | | 2 | 2016/17 PSU targets were based on combined performance of the Company for 2016 and 2017. The combined target was allocated between 2016 and 2017 in the graph in the same proportion as actual non-GAAP EPS in such years such that the same level of achievement is reflected in both years. | | 3 | Increase in target (compound annual growth for 2017/18 PSUs) vs. prior year actual Company performance. | | 4 | 2019 goal excludes any changes to the regulatory environment, including with respect to immigration and taxes. See our 2017 Annual Report for these and other risk factors that may impact our ability to achieve this goal. | | 5 | Comparison assumes $100 was invested, from December 31, 2012 through December 31, 2017, in Cognizant common stock, the S&P 500 Index, the Nasdaq 100 Index and our peer group (capitalization weighted), and that all dividends were reinvested. | | 6 | Consists of the following information technology consulting firms: Accenture plc, DXC Technology (previously Computer Sciences Corporation), ExlService Holdings Inc., Genpact Limited, Infosys Limited, Syntel, Inc., Wipro Limited and WNS (Holdings) Limited. Historically also included Computer Task Group, Inc. (old peer group not presented separately as it is not materially different from the above). |

2018 Proxy Statement 7

Table of Contents Proxy Statement Summary AUDIT Career Highlights

●President of PepsiCo, Inc., a multinational food, snack and beverage company (2012 – 2014)

●Executive positions with PepsiCo Europe Region

●CEO (2009 – 2012)

●President (2006 – 2009)

●Various senior positions with PepsiCo (1995 – 2006)

| | Current Public Company Boards

●The TJX Companies, Inc., a retailer of apparel and home fashions

●Corporate Governance Committee

●Finance Committee

| | Other Positions

●Member of the Imperial College Business School Advisory Board

●Board Advisor, Mars, Incorporated

Education

●B.S., Imperial College, London UniversityBetsy S. Atkins

| Proposal 3 | Ratify the Appointment of PricewaterhouseCoopers LLP as the Company’s Independent Registered Public Accounting Firm for 2018 | ●The Audit Committee believes that the engagement of PricewaterhouseCoopers LLP is in the best interests of the Company and its stockholders. |  | The Board unanimously recommends a voteFORthe Ratification of the Appointment of PricewaterhouseCoopers LLP as our Independent Registered Public Accounting Firm for 2018. |  | See page 44 for further information |

ADDITIONAL PROPOSALS Company Proposals | Proposal 4 | Approve an Amendment and Restatement of the Company’s 2004 Employee Stock Purchase Plan | ●An amendment and restatement of the Company’s ESPP is proposed to increase the number of authorized shares by 12,000,000, providing a share reserve sufficient for the next 4 to 5 years. ●The Amended and Restated ESPP also provides additional flexibility for the Compensation Committee to make adjustments upon various corporate events to maintain intended benefits of awards under the plan. |  | The Board unanimously recommends a voteFORthe Amendment and Restatement of the Company’s 2004 Employee Stock Purchase Plan. |  | See page 47 for further information |

| Proposals 5(a), (b) and (c) | Approve Three Separate Proposals to Eliminate the Supermajority Voting Requirements in the Company’s Certificate of Incorporation | ●At the 2017 Annual Meeting, stockholders voted overwhelmingly (99.8% of the votes cast) in favor of a stockholder proposal requesting that the Board take the steps necessary to eliminate the supermajority voting provisions in the Company’s Certificate of Incorporation and By-laws. The Board supported this proposal. ●To implement the intent of the 2017 proposal, stockholders are requested to approve the following three separate proposals to eliminate the supermajority voting requirements in the Company’s Certificate of Incorporation with respect to: (a)Amending the Company’s By-laws; (b)Removing directors; and (c)Amending certain provisions of the Company’s Certificate of Incorporation. |  | The Board unanimously recommends a voteFOReach of these proposals. |  | See page 52 for further information |

8 Cognizant Technology Solutions Corporation

Table of Contents Proxy Statement Summary Stockholder Proposals | Proposal 6 | | | Consider a Stockholder Proposal Requesting that the Board take the Steps Necessary to Permit Stockholder Action by Written Consent | |  | The Board unanimously recommends a vote AGAINST this proposal. |  | See page 56 for further information | | |

Independent

CEO and Founder of Baja Corp.

| | Director Since2017

Age63

BirthplaceUnited States | | Committees

●None

| | Skills and Qualifications Career Highlights| Proposal 7 | | | Consider a Stockholder Proposal Requesting that the Board take the Steps Necessary to Lower the Ownership Threshold for Stockholders to Call a Special Meeting | |  | The Board unanimously recommends a vote AGAINST this proposal. |  | See page 58 for further information | |

2018 Proxy Statement 9

Table of Contents

●CEO and Founder of Baja Corp., a venture capital investment firm (since 1994)

●CEO of Clear Standards, Inc., a provider of energy management and sustainability software and solutions (2009 – 2010)

●Chair and CEO of NCI, Inc., a neutraceutical functional food company (1991 – 1993)

●Co-Founder of Ascend Communications, Inc., a manufacturer of communications equipment, and Director (1989 – 1999)

●EVP of Sales Marketing, Professional Services and International Operations

| | Current Public Company Boards

●HD Supply Holdings, Inc., a wholesaler of electrical, plumbing and hardware products

●Lead Independent Director

●Compensation Committee

●Nominating and Corporate Governance Committee (Chair)

●Schneider Electric SE, a manufacturer of motors and generators

●Strategy Committee

●SL Green Realty Corporation, a fully integrated real estate investment trust (REIT)

●Audit Committee

| | Other Positions

●Member of advisory board of SAP SE, an enterprise software company

●Member of board of directors of privately-held Volvo Car AB, an automobile manufacturer

Past Director Positions

●Ascend Communications, Inc.

●Chico’s FAS, Inc.

●Vonage Holdings Corp.

●Clear Standards, Inc.

●Darden Restaurants, Inc.

●NASDAQ LLC

●Polycom, Inc.

Education

| Proposal 1 | | | Election of Directors | | What are you voting on? At the Annual Meeting, 11 Directors are to be elected to hold office until the 2019 Annual Meeting and until their successors have been duly elected and qualified. All nominees are current Directors and all except Mr. Velli were elected by stockholders at the 2017 Annual Meeting. | |  | The Board unanimously recommends a vote FOR all the Director nominees listed below. | | | |

Director Nominees | Zein Abdalla Former President of PepsiCo, Inc. |  | | Independent Director Since2015 Age59 BirthplaceSudan | | Committees ACGC Skills and Qualifications | Career Highlights ●President of PepsiCo, Inc., a multinational food, snack and beverage company (2012 – 2014) ●Executive positions with PepsiCo Europe Region ●CEO (2009 – 2012) ●President (2006 – 2009) ●Various senior positions with PepsiCo (1995 – 2006) | | Current Public Company Boards ●The TJX Companies, Inc., a retailer of apparel and home fashions (since 2012) | | Select Other Positions ●Member of the Board of Directors of Mastercard Foundation ●Member of the Board of Directors of Kuwait Food Company (Americana) K.S.C.P. ●Member of the Imperial College Business School Advisory Board ●Board Advisor, Mars, Incorporated Education ●B.S., Imperial College, London University |

| Betsy S. Atkins CEO and Founder of Baja Corp. |  | | Independent Director Since2017 Age64 BirthplaceUnited States | | Committees CCFPC Skills and Qualifications | Career Highlights ●CEO and Founder of Baja Corp., a venture capital investment firm (since 1994) ●CEO of Clear Standards, Inc., a provider of energy management and sustainability software and solutions (2009 – 2010) ●Chair and CEO of NCI, Inc., a nutraceutical functional food company (1991 – 1993) ●Co-Founder of Ascend Communications, Inc., a manufacturer of communications equipment, and Director (1989 – 1999) ●EVP of Sales Marketing, Professional Services and International Operations | | Current Public Company Boards ●Schneider Electric SE, a manufacturer of energy management systems (since 2011) ●SL Green Realty Corporation, a fully integrated real estate investment trust (REIT) (since 2015) ●Wynn Resorts, Limited, a destination casino resorts company (since 2018) | | Select Other Positions ●Member of the Board of Directors of privately-held Volvo Car AB, an automobile manufacturer Select Past Director Positions ●Ascend Communications, Inc. ●Chico’s FAS, Inc. ●Clear Standards, Inc. ●Darden Restaurants, Inc. ●HD Supply Holdings, Inc. ●Nasdaq LLC ●Polycom, Inc. Education ●B.A., University of Massachusetts, Amherst |

| AC | Audit Committee | FPC | Financial Policy Committee | | Committee Chair | | CC | Compensation Committee | GC | Governance Committee | | Committee Member | | | $ | AC Financial Expert | | |

10 Cognizant Technology Solutions Corporation

Table of Contents | Maureen Breakiron-Evans Former CFO of Towers Perrin |  | | Independent Director Since2009 Age63 BirthplaceUnited States | | Committees $ACGC Skills and Qualifications | Career Highlights ●CFO of Towers Perrin, a global professional services company (2007 – 2008) ●VP and General Auditor of CIGNA Corporation, a health services organization (2005 – 2006) ●EVP and CFO of Inovant, LLC, VISA’s captive technology development and transaction processing company (2001 – 2004) ●16 years in public accounting, ultimately as a partner at Arthur Andersen LLP through 1994 | | Current Public Company Boards ●Ally Financial Inc., an Internet bank (since 2015) ●Cubic Corporation, a provider of systems and services to transportation and defense markets worldwide (since 2017) | | Select Past Director Positions ●Federal Home Loan Bank of Pittsburgh, a private government-sponsored enterprise ●Heartland Payment Systems, Inc., a provider of payment processing services ●ING Direct, an Internet bank Education ●B.B.A., Stetson University ●M.B.A., Harvard Business School ●M.L.A., Stanford University Certifications ●CPA in California Former CFO of

Towers Perrin

| | Director Since2009

Age62

BirthplaceUnited States | | Committees

●Audit (Chair)

●Governance

| | Skills and Qualifications | | Career Highlights

●CFO of Towers Perrin, a global professional services company (2007 – 2008)

●VP and General Auditor of CIGNA Corporation, a health services organization (2005 – 2006)

●EVP and CFO of Inovant, LLC, VISA’s captive technology development and transaction processing company (2001 – 2004)

●16 years in public accounting, ultimately as a partner at Arthur Andersen LLP through 1994

| | Current Public Company Boards

●Ally Financial Inc., a provider of payment processing services

●Audit Committee

●Digital Transformation Committee

●Cubic Corporation, a provider of systems and services to transportation and defense markets worldwide

●Audit Committee

●Nominating and Corporate Governance Committee

| | Past Director Positions

●Federal Home Loan Bank of Pittsburgh, a private government-sponsored enterprise

●ING Direct, an Internet bank

●Heartland Payment Systems, Inc.

Education

●B.B.A., Stetson University

●M.B.A., Harvard Business School

●M.L.A., Stanford University

Certifications

●CPA in California

|

| Jonathan Chadwick Former CFO and COO of VMware, Inc. |  | | Independent Director Since2016 Age52 BirthplaceUnited Kingdom | | Committees $AC Skills and Qualifications |

Jonathan ChadwickCareer Highlights ●Executive positions with VMware, Inc., a virtualization and cloud infrastructure solutions company ●COO (2014 – 2016) ●EVP and CFO (2012 – 2016) ●CFO of Skype Technologies S.A., an Internet communications company, and Corporate VP of Microsoft Corporation (2011 – 2012) ●EVP and CFO of McAfee, Inc., a security technology company (2010 – 2011) | | ●Various executive positions with Cisco Systems, Inc., a developer and manufacturer of networking and telecommunications equipment (1997 – 2010) ●Various positions with Coopers & Lybrand, an accounting firm (1993 – 1997) | | Current Public Company Boards ●F5 Networks, Inc., a technology company that specializes in application delivery networking (since 2011) ●ServiceNow, Inc., a cloud computing company (since 2016) Education ●B.Sc., University of Bath, U.K. Certifications ●Chartered Accountant in England and Wales | |  Independent

Former CFO and Coo of VMware, Inc.

| | Director Since2016

Age51

BirthplaceUnited Kingdom | | Committees

●Audit

| | Skills and Qualifications | | Career Highlights

●Executive positions with VMware, Inc., a virtualization and cloud infrastructure solutions company

●COO (2014 – 2016)

●EVP and CFO (2012 – 2016)

●CFO of Skype Technologies S.A., an Internet communications company, and Corporate VP of Microsoft Corporation (2011 – 2012)

●EVP and CFO of McAfee, Inc., a security technology company (2010 – 2011)

| | ●Various executive positions with Cisco Systems, Inc. (1997 – 2010)

●Various positions with Coopers & Lybrand, an accounting firm (1993 – 1997)

Current Public Company Boards

●F5 Networks, Inc.

●Audit Committee (Chair)

●ServiceNow, Inc.

●Audit Committee

●Leadership Development and Compensation Committee

| | Education

●B.Sc., University of Bath, U.K.

Certifications

●Chartered Accountant in England and Wales

| |

| John M. Dineen Former President and CEO of GE Healthcare |  | | Independent Director Since2017 Age55 BirthplaceUnited States | | Committees FPCGC Skills and Qualifications |

John M. DineenCareer Highlights ●Operating Advisor of Clayton, Dubilier & Rice LLC, an investment firm (since 2015) ●Executive positions with General Electric Company, a global digital industrial company ●CEO, GE Healthcare (2008 – 2014) ●CEO, GE Transportation (2005 – 2008) ●Other leadership positions (1986 – 2005) | | Current Public Company Boards ●Merrimack Pharmaceuticals, Inc., a pharmaceutical company specializing in the development of drugs for the treatment of cancer (since 2015) | | Education | | Independent

Former President and CEO of GE Healthcare

| | Director Since2017

Age54

BirthplaceUnited States | | Committees

●None

| | Skills and Qualifications | | Career Highlights

●Operating Advisor of Clayton, Dubilier & Rice LLC, an investment firm (since 2015)

●Executive positions with General Electric Company, a global digital industrial company

●CEO, GE Healthcare (2008 – 2014)

●CEO, GE Infrastructure and GE Transportation (2005 – 2008)

●Other leadership positions (1986 – 2005)

| | Current Public Company Boards

●Merrimack Pharmaceuticals, Inc., a pharmaceutical company specializing in the development of drugs for the treatment of cancer

●Organization and Compensation Committee (Chair)

| | Education

●B.S., University of Vermont | |

| AC | Audit Committee | FPC | Financial Policy Committee | | Committee Chair | | CC | Compensation Committee | GC | Governance Committee | | Committee Member | | | $ | AC Financial Expert | | |

2018 Proxy Statement 11

Table of Contents | Francisco D’Souza CEO of Cognizant |  | | Director Since2007 Age49 BirthplaceKenya | | Committees FPC Skills and Qualifications | Career Highlights ●Executive positions at Cognizant ●CEO (since 2007) ●President (2007 – 2012) ●COO (2003 – 2006) ●SVP, North American Operations and Business Development (1999 – 2003) ●VP, North American Operations and Business Development (1998 – 1999) ●Director - North American Operations and Business Development (1997 – 1998) ●Joined Cognizant as a co-founder in 1994, the year it was started as a division of The Dun & Bradstreet Corporation | | Current Public Company Boards ●General Electric Company (since 2013) | | Select Other Positions ●Member of the Board of Trustees of Carnegie Mellon University ●Co-Chair of the Board of Trustees of The New York Hall of Science Education | | Director Since2007

Age48

BirthplaceKenya | | Committees

●None

| | Skills and Qualifications | | Career Highlights

●Executive positions at Cognizant

●CEO (since 2007)

●President (2007 – 2012)

●COO (2003 – 2006)

●SVP, North American Operations and Business Development (1999 – 2003)

●VP, North American Operations and Business Development (1998 – 1999)

●Director - North American Operations and Business Development (1997 – 1998)

| | ●Joined Cognizant as a co-founder in 1994, the year it was started as a division of The Dun & Bradstreet Corporation

Current Public Company Boards

●General Electric Company

●Technology and Industrial Risk Committee

| | Other Positions

●Member of the Board of Trustees of Carnegie Mellon University

●Co-Chairman of the Board of Trustees of The New York Hall of Science

●Member of the Board of Directors of the U.S.–India Business Council

Education

●B.B.A., University of Macau (formerly University of East Asia) ●M.B.A., Carnegie Mellon University |

| John N. Fox, Jr. Former Vice Chairman of Deloitte & Touche LLP and Global Director, Strategic Clients of Deloitte Consulting |  | | Independent Director Since2007 Age75 BirthplaceUnited States | | Committees CCGC Skills and Qualifications | Career Highlights ●Vice Chairman of Deloitte & Touche LLP, a global professional services firm, and Global Director, Strategic Clients for Deloitte Consulting (1998 – 2003) ●Member of Deloitte Touche Tohmatsu Board of Directors and the Board’s Governance (Executive) Committee (1998 – 2003) ●Various senior positions with Deloitte Consulting (1968 – 2003) | | Current Public Company Boards ●VASCO Data Security International, Inc., an information technology security company (since 2005) | | Select Other Positions ●Trustee for Steppenwolf Theatre Company ●Trustee for Wabash College Education ●B.A., Wabash College ●M.B.A., University of Michigan |

| John E. Klein Chairman of Cognizant and President and CEO of Polarex, Inc. |  | | Independent Director Since1998 Age76 BirthplaceUnited States | | Committees ACCCGC Skills and Qualifications | Career Highlights ●Chairman of Cognizant (since 2003) ●President and CEO of Polarex, Inc., a technology consulting firm (employed since 1994) ●Previously President and CEO of MDIS Group, PLC, a UK listed software and services company | | ●VP at International Business Machines Corporation, or IBM, a multinational technology company ●VP at Digital Equipment Corporation, a worldwide computer hardware and software company | | Education ●B.S., U.S. Merchant Marine Academy ●M.B.A., New York University |

John N. Fox, Jr. | | |  Independent

Former Vice Chairman of Deloitte & Touche LLP and Global Director, Strategic Clients of Deloitte Consulting

| | Director Since2007

Age74

BirthplaceUnited States | | Committees

●Compensation (Chair)

●Governance

| | Skills and Qualifications |

●Vice Chairman of Deloitte & Touche LLP, a global professional services firm, and Global Director, Strategic Clients for Deloitte Consulting (1998 – 2003)

●Member of Deloitte Touche Tohmatsu Board of Directors and the Board’s Governance (Executive) Committee (1998 – 2003)

●Various senior positions with Deloitte Consulting (1968 – 2003)

| | Current Public Company Boards

●VASCO Data Security International, Inc., an information technology security company

●Audit Committee

●Compensation Committee (Chair)

●Nominating and Corporate Governance Committee

| | Other Positions

●Trustee for Wabash College

●Trustee for Steppenwolf Theatre Company

Education

●B.A., Wabash College

●M.B.A., University of Michigan

| AC | Audit Committee | FPC | Financial Policy Committee | | Committee Chair | | CC | Compensation Committee | GC | Governance Committee | | Committee Member | | | $ | AC Financial Expert | | |

12 Cognizant Technology Solutions Corporation

Table of Contents | Leo S. Mackay, Jr. SVP, Internal Audit, Ethics and Sustainability of Lockheed Martin Corporation |  | | Independent Director Since2012 Age56 BirthplaceUnited States | | Committees AC Skills and Qualifications |

John E. KleinCareer Highlights ●Executive positions at Lockheed Martin Corporation, a global security and aerospace company ●SVP, Internal Audit, Ethics and Sustainability (since 2016) ●VP, Ethics and Sustainability (2011 – 2016) ●VP, Corporate Business Development and various other positions (2007 – 2011) ●President, Integrated Coast Guard Systems LLC and VP and General Manager, Coast Guard Systems (2005 – 2007) | | ●Chief Operations Officer of ACS State Healthcare LLC, a services company serving the healthcare industry (2003 – 2005) ●Various positions with Bell Helicopter, a helicopter and tiltrotor craft manufacturer Select Other Positions ●Director of USAA Federal Savings Bank | | Select Past Director Positions ●Chair of the Board of Visitors of the Graduate School of Public Affairs at the University of Maryland ●Center for a New American Security Education | |  Independent

Chairman of Cognizant and President and CEO of Polarex, Inc.

| | Director Since1998

Age75

BirthplaceUnited States | | Committees

●Audit

●Compensation

●Governance

| | Skills and Qualifications | | Career Highlights

●Chairman of Cognizant (since 2003)

●President and CEO of Polarex, Inc., a technology consulting firm (employed since 1994)

●Previously President and CEO of MDIS Group, PLC, a UK listed software and services company

| | ●VP at International Business Machines Corporation, or IBM

●VP at Digital Equipment Corporation

| | Education

●B.S., U.S. Merchant Marine Academy

●M.B.A., New York University

| |

|

12 | Cognizant Technology Solutions Corporation |

Table of Contents

Leo S. Mackay, Jr. | |  Independent

SVP, Internal

Audit, Ethics and

Sustainability of

Lockheed Martin

Corporation

| | Director Since2012

Age55

BirthplaceUnited States | | Committees

●Audit

| | Skills and Qualifications | | Career Highlights

●Executive positions at Lockheed Martin Corporation, a global security and aerospace company

●SVP, Internal Audit, Ethics and Sustainability (since 2016)

●VP, Ethics and Sustainability (2011 – 2016)

●VP, Corporate Business Development and various other positions (2007 – 2011)

| | ●President, Integrated Coast Guard Systems LLC and VP and General Manager, Coast Guard Systems (2005 – 2007)

●Chief Operations Officer of ACS State Healthcare LLC, a services company serving the healthcare industry (2003 – 2005)

●Various positions with Bell Helicopter, a helicopter and tiltrotor craft manufacturer

| | Past Director Positions

●Chair of the Board of Visitors of the Graduate School of Public Affairs at the University of Maryland

●Center for a New American Century

Education

●B.S., United States Naval Academy ●M.P.P., Harvard University ●Ph.D., Harvard University |

| Michael Patsalos-Fox Former CEO of Stroz Friedberg and Former Chairman, the Americas and Senior Partner of McKinsey & Company |  | | Independent Director Since2012 Age65 BirthplaceCyprus | | Committees CCFPCGC Skills and Qualifications | Career Highlights ●CEO of Stroz Friedberg, a global investigation and cyber security firm (2013 – 2016) ●Senior Partner and various other positions with McKinsey & Company, a global management consulting company (1981 – 2013) ●Board of Directors (1998 – 2010) ●Chairman, the Americas (2003 – 2009) | | ●Member of Operating Committee ●Managing Partner of New York and New Jersey offices, North American Corporate Finance and Strategy practice and European Telecoms practice ●Leader of new business growth opportunities around data, analytics and software | | Education ●B.S., University of Sydney ●M.B.A., International Institute for Management Development |

| Joseph M. Velli Former Senior Executive Vice President of The Bank of New York |  | | Independent Director Since2017 Age60 BirthplaceUnited States | | Committees AC Skills and Qualifications | Career Highlights ●Senior Advisor of Lovell Minnick Partners, LLC, private equity firm (since 2016) ●Chairman and Chief Executive Officer of Convergex Group, LLC, a provider of software platforms and technology-enabled brokerage services (2006 – 2013) ●Executive positions with The Bank of New York (now BNY Mellon), a worldwide banking and financial services company ●Senior Executive Vice President and member of the Senior Policy Committee (1998 – 2006) ●Executive Vice President (1992 – 1998) ●Other leadership positions (1984 – 1992) | | Current Public Company Boards ●Computershare Limited, a global provider of corporate trust, stock transfer, employee share plan and mortgage servicing services (since 2014) ●Paychex, Inc., a provider of payroll, human resource and benefits outsourcing services (since 2007) | | Select Past Director Positions ●E*Trade Bank ●E*Trade Financial Corporation Education ●B.A., William Paterson University ●M.B.A., Fairleigh Dickinson University |

Michael Patsalos-Fox | | |  Independent

Former CEO of

Stroz Friedberg and

Former Chairman,

the Americas and

Senior Partner of

McKinsey & Company

| | Director Since2012

Age64

BirthplaceCyprus | | Committees

●Compensation

●Governance (Chair)

| | Skills and Qualifications |

●CEO of Stroz Friedberg, a global investigation and cyber security firm (2013 – 2016)

●Senior Partner and various other positions with McKinsey & Company, a global management consulting company (1981 – 2013)

●Board of Directors (1998 – 2010)

●Chairman, the Americas (2003 – 2009)

| | ●Member of Operating Committee

●Managing Partner of New York and New Jersey offices, North American Corporate Finance and Strategy practice and European Telecoms practice

●Leader of new business growth opportunities around data, analytics and software

| | Education

●B.S., University of Sydney

●M.B.A., International Institute for Management Development

| AC | Audit Committee | FPC | Financial Policy Committee | | Committee Chair |

Robert E. Weissman| CC | Compensation Committee | GC | Governance Committee | | Committee Member | | | $ | AC Financial Expert | | | |  Independent

Chairman of Shelburne

Investments and

Retired Chairman and

CEO of The Dun &

Bradstreet Corporation

| | Director Since2001

Age | |

2018 Proxy Statement 76

BirthplaceUnited States | | Committees

●Compensation

●Governance

| | Skills and Qualifications | | Career Highlights

●Chairman and CEO of IMS Health, a provider of information to the pharmaceutical and healthcare industries (1998 – 1999)

●Chairman and CEO of Cognizant (1996 – 1997)

●Executive positions at The Dun & Bradstreet Corporation, a data, analytics and insights company

●Chairman and CEO (1995 – 1996)

●President and COO (1985 – 1995)

●Other positions since 1979

| | ●President and CEO of National CSS, a computer time-sharing company acquired by The Dun & Bradstreet Corporation in 1979

Past Public Company Boards

●State Street Corporation, a global financial services company

●Pitney Bowes, Inc., a global technology company

●Information Services Group, a technology insights, market intelligence and advisory services company

| | Other Positions

●Chairman of Shelburne Investments, a private investment company that works with emerging companies in the United States and Europe

●Board of Trustees of Babson College

Education

●B.S., Babson College

●Honorary Doctor of Laws, Babson College

|

|

Table of Contents

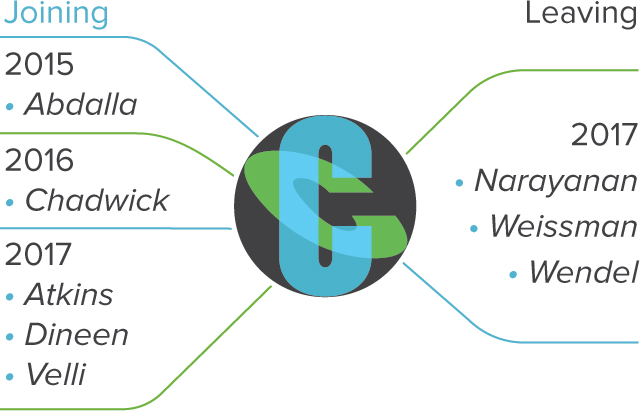

| | Directors Not Standing for Reelection |

Lakshmi Narayanan and Thomas M. Wendel, two of our current Directors, have not been nominated for re-election as Directors at the Annual Meeting following the end of their current terms.

BOARD COMPOSITION

Table of Contents Board Composition Director Independence Board Member Independence  10 of 11

Directors

Nominees

are

Independent | | Each of our Director nominees, other than our CEO, Mr. D’Souza, has been determined by the Board to be an “independent director” under our Corporate Governance Guidelines and the rules of The NASDAQNasdaq Stock Market LLC (“NASDAQ”Nasdaq”), which require that, in the opinion of the Board, such person not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a Director.

|

Committee Member Independence  The Board has determined that all of the members of the Audit Committee, Compensation Committee and Governance Committee are independent as defined under NASDAQ rules and, where applicable, also satisfy the committee-specific requirements set forth below.

100% Independent

Directors on Audit,

Compensation

and Governance

Committees | | The Board has determined that all of the members of the Audit Committee, Compensation Committee and Governance Committee are independent as defined under Nasdaq rules and, where applicable, also satisfy the committee-specific requirements set forth below. |

HEIGHTENED COMMITTEE STANDARDSAdditional Audit and Compensation Committee Independence Standards

| | | | Audit Committee | | Compensation Committee

| All members of the Audit Committee are required to satisfy the independence requirements contemplated by Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and NASDAQNasdaq rules, specificallywhich require that Audit Committee members maymembers: ●May not accept any direct or indirect consulting, advisory or other compensatory fee from the Company or any of its subsidiaries, except for their compensation for Board service,service; and that Audit Committee members may ●May not be affiliated with the Company or any of its subsidiaries. Compensation Committee | | Under NASDAQNasdaq rules, the Board must affirmatively determine the independence of each member of the Compensation Committee after considering allconsidering: ●All sources of compensation of the director, including any consulting, advisory or other compensation paid by the Company or any of its subsidiaries,subsidiaries; and whether ●Whether the Compensation Committee member is affiliated with the Company or any of its subsidiaries. |

Director Recruitment and Selection Process Director Candidate Identification ●Independent search firm, independent directors, management, stockholders and others may recommend potential candidates for election to the Company’s Board ●A subset of directors may be tasked by the Governance Committee with leading a search process for director candidates |  | Governance Committee ●Develops criteria for any director search process, including any specific desired skills, experiences or qualifications ●Discusses, assesses and interviews candidates ●Evaluates the candidates, including with respect to | ●Integrity ●Business acumen ●Experience ●Diligence ●Independence / absence of conflicts of interest ●Capacity to serve in light of other commitments ●Diversity | | No specific weighting is given to any of the criteria, nor is any a prerequisite |

●Recommends nominees to the Board |  | Board ●Discusses and interviews candidates ●Analyzes independence ●Appoints directors to the Board ●Recommends nominees for stockholder vote at the next annual meeting |  | Stockholders ●Vote on nominees at annual meeting | | | Director CandidatesObjective:Maintain an engaged, independent Board with broad and diverse experience and judgment that is committed to representing the long-term interests of our stockholders

|

Finding Directors

The Governance Committee seeks recommendations from Board members and others, engages search firms from time-to-time to assist in the identification and evaluation of director candidates, meets periodically to evaluate biographical information and background material relating to potential candidates and has selected candidates interviewed by members of the Governance Committee and the Board.

In 2016 and 2017, the Company engaged a third party director search firm to assist the Governance Committee in identifying and evaluating director candidates. In February 2017, the Company and Elliott Management agreed to each identify and propose one new independent director for election to the Board, subject to the consent of the other, prior to the filing of thisthe proxy statement.statement for the 2017 Annual Meeting. Ms. Atkins and Mr. Dineen were eachelected to the Board in April 2017 through this process. As part of the February 2017 agreement, the Company and Elliott also agreed that the Company would propose one additional new independent director for election to the Board, subject to the consent of Elliott, prior to the filing of the proxy statement for the 2018 Annual Meeting. Mr. Velli was identified withby the assistance of a third party search firm,Company, consented to by Elliott and Ms. Atkins was approved by Elliott.joined the Board in December 2017. Director Selection14 Cognizant Technology Solutions Corporation

Table of Contents Important Factors in Assessing Board Composition The Governance Committee strives to maintain an engaged, independent Boardboard with broad and diverse experience and judgment that is committed to representing the long-term interests of our stockholders. In considering whether to recommend any particular candidate for inclusion in the Board’s slateThe committee considers a wide range of recommended Director nominees, the Governance Committee applies the criteria in our Corporate Governance Guidelines. These criteria include the candidate’s integrity, business acumen, knowledge of our businessfactors when selecting and industry, experience, diligence, absence of conflicts of interest, capacity to serve in light of commitments to other public company boards, and the ability to act in the interests of all stockholders, and includes consideration of the value of Board diversity. In evaluating Directorrecruiting director candidates, the Governance Committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. We believe that the backgrounds, qualifications and diversity of our Directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. 14 | Cognizant Technology Solutions Corporation |

Table of Contents

The Governance Committee’s Director candidate selection includes the following considerations:including:

| ● | Ensuring an experienced, qualified Board with expertise in areas relevant to the Company.We seek directors who have held significant leadership positions and have global business experience, especially in the consulting and technology industries in which we compete. In addition, we seek directors with the financial reporting, operational, corporate governance and compliance experience appropriate for a large, global, publicly traded company. |

| Leadership

11(100%) | | We believe that directors who have held significant“C-suite” leadership positions over an extended period especially CEO positions, possess extraordinary leadership qualities, and the ability to identify and develop thoseleadership qualities in others. TheySuch Directors demonstrate a practical understanding of organizations, processes, strategy and risk management, and know how to drive change and growth. | | Global Business

Experience

11 (100%) | | With nearly 22%23% of our revenue currently coming from, and our continued success dependent, in part, on continued growth in, our business outside the United States, and with the extensive international aspects of our business operations, we believe that global business experience is an important quality for many of our Directors to possess. | | Technology and

Consulting

Services

4(36%) | | Consulting,Technology and consulting services, including as to information technology, strategy, business and operations, is one of our key areas of business focus. It is an important component of the continuing growth of our business and permeates other important growth areas for us. As technology and consulting isservices are a critical component of our efforts to develop ever more strategic relationships with clients, it is important to have directors with consulting experience.experience in providing such services to clients.

| | Technology

10 (91%) | | As a leading information technology company, developingDeveloping and investing in new technologies and ideas is at the heart of our business. Our current investments include building capabilities to enable clients to drive digital transformation at scale and create next generation information technology infrastructures, and building platform-based solutions and industry utilities to enable clients to achieve new levels of efficiency. In addition, strong data / cyber security is also essential for our business. As such, having directors with technology experience is as important as ever.

| | Financial

1011 (100%) (91%)

| | We use a broad set of financial metrics to measure our operating and strategic performance and stockholder value creation. Accurate financial reporting and strong internal controls are also critical to our success. It is therefore important for us to have directors with an understanding of financial statements and financial reporting processes and a track record of stockholder value creation. | | Operational

10 (91%) | | We consider operational experience to be a valuable trait. Directors with this experience provide insight into best practices for the efficient administration and operation of a complex business to achieve growth and margin objectives. |

| ● | Enhancing the Board’s Diversity.diversity.Our Corporate Governance Guidelines provide that the value of director diversity, including as to race, gender, age, national origin and cultural background, should be considered in the selection of directors. The Governance Committee seeks out qualified women and individuals from minority groups to include in the pool from which Board nominees are chosen.

| | | | ● | Achieving a Balanced Mixbalanced mix of Tenures.tenures.The Governance Committee believes it is important that the Board have an appropriately balanced mix of experienced directors with a deep understanding of the Company and its industry and new directors who bring a fresh perspective and valuable new experience and insights.

| | | | ● | Maintaining Director Engagement.engagement.The Governance Committee considers each Director’s continuation on the Board on an annual basis. As part of the process, the Committeecommittee evaluates the Director’s other positions and obligations in order to assess the Director’s ability to continue to devote sufficient time to Company matters. Any Director who experiences a change in employment status or job responsibilities, other than retirement, is required to notify the Chairman and the Governance Committee and offer to resign from the Board.

| | | | ● | Avoiding conflicts of interest.The Governance Committee looks at other positions a director candidate has held or holds (including other board memberships) and any potential conflicts of interest to ensure the continued independence of the Board and its committees. There are no family relationships among any of our executive officers, directors and key employees. |

2018 Proxy Statement 15

Table of Contents As part of the Governance Committee’s annual self-assessment process, it assesses its performance as to all aspects of the selection and nomination process for directors, including diversity. Based on the experience, qualifications, attributes and skills of our Director nominees as highlighted herein, our Governance Committee has concluded that such Director nominees should continue to serve on the Board.

Table of Contents